Mortgage and Home Loan Rates

1st Summit offers competitive Mortgage and Home Loan rates.

Our great Mortgage and Home Loan rates, plus our unparalleled customer service, are what differentiate us from our competitors.

Whether you want to buy a new home, make improvements to your current home, or use the equity in your home to finance a project like college tuition, 1st Summit Bank will go the extra mile to help you attain those dreams and goals.

Our Home Equity Loan rates and our Home Equity Line of Credit rates will help make your home improvement projects a reality! Quit dreaming and start doing!

Rates are accurate as of Wednesday, April 17, 2024

Residential Mortgage Loans

| First Lien Owner Occupied | ||||||

|---|---|---|---|---|---|---|

| <= 180 months | ||||||

| 181-240 months | ||||||

| 241-360 months | ||||||

Home Equity Term Loan***

| First Lien Owner Occupied | ||

|---|---|---|

| 12-120 months | ||

| 121-180 months |

| Junior Lien - Owner Occupied Real Estate Only | ||

|---|---|---|

| 60 months or less | ||

| 61-120 months | ||

| 121-180 months |

| Sewer Line Upgrade Program-Unsecured | |

|---|---|

| up to 60 months | |

*AFT from 1ST SUMMIT checking required. $36.50 document preparation fees apply. Subject to credit approval. Minimum 700 credit score required to receive rate.

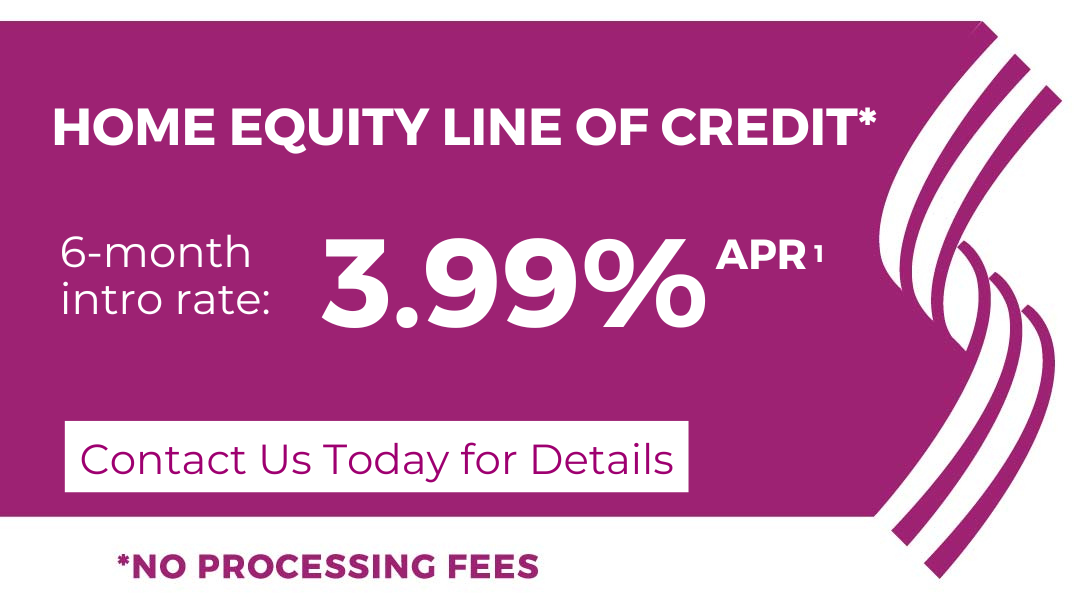

Home Equity Line of Credit***

| Variable Rate**** | ||

Let's Talk About Your Options

These rates are based on a credit review and your rate may be higher based on your credit score, property type, loan to value and mortgage product. If the loan exceeds $250,000, title insurance is required.

The example mortgage Annual Percentage Rate (APR)s shown above are based on loans secured by a single-family primary residence and are calculated using a $100,000 loan amount at 80% loan-to-value (LTV).

*Relationship Rate: Available to customer who has four or more unique services with the bank, including the new loan/line. Services include Consumer Checking, Business Checking, Savings, Smart Savers Account, Money Market, Holiday Club, Certificate of Deposit, Credit Card Merchant Service, Mortgage Loan, Personal Line/Loan, VISA® Credit Card, Commercial Line/Loan, Trust/Estate, Brokerage, Safe Deposit Box.

** First Time Home Buyer Program: 0% Origination Fee and $0.00 Document Preparation fee.

*** For Home Equity Loans or Lines of Credit under $250,000 where collateral property is located within Pennsylvania, origination fees are waived, and automated valuation, credit, title and other processing fees are paid by the bank. Customer is responsible for the expense associated with a professional appraiser, if required. A professional appraisal may be required if the property is outside or PA or in a flood zone (SFHA) and may also be required by the bank, or requested by the customer, to confirm property value. Property insurance is always required. Flood insurance required where necessary. Subject to credit approval. Consult your tax advisor about the deductibility of interest. AFT from 1st Summit checking account required for Relationship Rate. HELOC charged a $25 annual fee.

****Variable rate on the Line of Credit based on NY Prime rate and has a floor rate of 4.50% and the maximum rate is 18%.

1-Offer is effective July 21, 2023. Offer may be changed or discontinued at any time. Offer requires a minimum new money loan or increase and/or draw of $10,000 with an automatic funds transfer (AFT) from a 1ST SUMMIT BANK checking account. To qualify for promotional offer, a Credit Score of 700+ is required. Maximum loan-to-value ratio is 80%. For Home Equity Loans or Lines of Credit under $250k, where collateral property is located within Pennsylvania, origination fees are waived, and automated valuation, credit, title, and other processing fees are paid by the bank. Customer is responsible for the expense associated with a professional appraisal, if required. A professional appraisal may be required if the property is outside of PA or in a flood zone (SFHA) and may also be required by the bank, or requested by the customer, to confirm property value. Property insurance is always required. Flood insurance required where necessary. Subject to credit approval. Other rates and terms are available. Consult your tax advisor about the deductibility of interest. The introductory period begins on the date of account opening. After the 6-month introductory period, the APR (Annual Percentage Rate) on a home equity line of credit will be a variable rate based on Wall Street Journal Prime Rate (8.50% as of this publication date) plus a margin (currently as low as Prime Rate plus 0.0% or .50%). The maximum rate is 18% and the product floor rate is 4.50%. This product has a $25 annual fee.

All of the above rates are subject to change and are provided for informational purposes only. Rates and terms are subject to borrower qualifications. Other terms and rates are available.